Feeder cattle's dramatic rise to record highs is certainly cause for celebration in the short term -- and anxiety for long-term planning.

Oil futures dropped Thursday morning following the revised report of the real gross domestic product (GDP) showing a decrease of 0.2% in the...

JBS USA has announced plans to build a $135 million sausage production facility in Perry, Iowa, creating 500 jobs where Tyson Foods closed its...

Blogger Meredith Bernard encourages people to enjoy the usually mild weather of May and take joy where you can find it.

P[] D[0x0] M[0x0] OOP[F] ADUNIT[] T[]

Mitch Miller has joined the DTN team as the DTN Contributing Canadian Grains Analyst following a long career in the grain and oilseed sector in south-central Manitoba, Canada. He jokes that he has been a primary producer for almost 40 years by necessity but a market analyst and strategist throughout that by passion.

A bachelor's degree in ag economics from the University of Manitoba initiated a lifelong focus on all things management and marketing. Although the decision was made to downsize the farm significantly in 2019, he proudly claims to still have enough acres to seed and cows to feed to remain grounded.

Too young to quit being productive, he hopes to share some of his experience and insight with readers to help with one of the most challenging tasks on the farm -- marketing the production successfully. A six-year span as a commodity broker and a lifelong career involved in the cash market should provide a unique balance from which to draw.

In an attempt to be transparent, he explains his approach to market analysis. Looking for clues from fundamental analysis, technical analysis and from the market participants themselves through the Commitment of Trader reports, a theory on price direction is developed. The more clues supporting the theory, the more confidence in it. That in turn influences the development of a successful marketing strategy. Through this role, he hopes to be able to share those clues as they are identified on an ongoing basis.

Feeder cattle's dramatic rise to record highs is certainly cause for celebration in the short term -- and anxiety for long-term planning.

Feeder cattle's dramatic rise to record highs is certainly cause for celebration in the short term -- and anxiety for long-term planning.

Feeder cattle's dramatic rise to record highs is certainly cause for celebration in the short term -- and anxiety for long-term planning.

Record low U.S. oat ending stocks and close to that in Canada for both old and new crop are sure to keep markets on edge and very sensitive to weather risks in the coming months.

If AAFC is wrong on its assumption that Statistics Canada past production estimates are incorrect for canola, then carryover could fall to unreasonably low levels given a negative Feed, Waste and Dockage total is not acceptable.

The soybean market is sure to see increased weather-related volatility in the year ahead following a much-lower-than-expected new-crop ending-stocks estimate.

Funds continue to aggressively sell old-crop corn (regardless of bullish fundamentals for it) as if that corn were facing the more bearish new-crop fundamentals.

With no revision higher to past production estimates, canola stocks remain uncomfortably tight.

China clearly used the tariffs that it had imposed on canola oil and meal imports as a trade advantage, completely dominating the canola seed export market in March.

With other spring wheat area being lost to corn at a greater rate than expected this year, the Minneapolis wheat premium to Chicago is poised to gain.

The Canadian dollar appears to have left a multi-decade low behind in February with a sharp rally off support. Long loonie risk management should now be a concern.

With yet another contract low set in Kansas City wheat and close to it in Chicago, the wheat/corn spread may be the best hope for a rally.

Various funds rushed back into the corn market with the underlying corn fundamentals of exceptional demand not changed, resulting in a $0.49/bushel rally in two weeks.

The canola market is finally acknowledging the tight supply situation that has been months in the making. At least it's early enough to encourage seeded area but is it too late to ration demand?

With corn export commitments to date only being exceeded once in the last 25 years, it should have come as no surprise when USDA finally raised their annual export estimate.

The soybean/corn price ratio initially suggested the March Prospective Plantings report likely marked peak corn acres; but a violent reaction to escalating tariff wars between the U.S. and China have reversed that outlook. If...

The pleasant surprise that Canada and Mexico were left out of any tariff changes Wednesday provided an unexpected boost for canola, allowing the gap down following the Chinese tariff announcement to be filled.

Soybean oil export commitments to date have only been exceeded twice in history. Both of those times resulted in final exports greater than 3.2 billion pounds compared to the USDA's initial estimate for 2024-25 of 600 million...

The soybean-corn price ratio is sending a clear signal to expect a switch from soybean acres to corn, but what about after the Prospective Plantings report? And is there a chance for a bullish surprise regardless?

A rushed announcement over the weekend ahead of a Canadian election call indicated the Liberal Government plans to deal with the Chinese tariff dispute by giving themselves an excuse to not deal with it.

The price you pay for record-high values is the anxiety and volatility that inevitably goes with them. That is one situation where technical analysis helped immensely.

The most important underlying corn fundamentals of exceptional demand have not changed, just anxiety over them has. If the political landscape calms, will investors buy back into corn the way they had previously?

With ending stocks in world exporting countries at multi-year low levels, thanks to increased domestic use amid lower production, prices should find solid underlying support.

The surprise moves by China to pick now to retaliate against tariffs announced six months ago by the Trudeau government brings up as many questions about the timing and motivation as it does about the impact.

With it becoming increasingly clear that there is nothing Canada do to alter tariff decisions made by U.S. President Trump, it may be time to identify alternatives for unwanted exports.

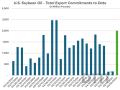

Soybean oil exports for 2024-25 are almost certainly going to be revised higher given that total commitments in the first five months of the marketing year now exceed USDA's annual projection.